Volatile but avoidable: guarding against the power crisis

Volatile but avoidable: Guarding against the power crisis

It’s been a challenging winter for New Zealand’s electricity generation sector and power grid. Though this is nothing out of the ordinary, a November 2023 Ministry of Business Innovation & Employment (MBIE) briefing to the Hon. Simeon Brown, Minister for Energy, warned that tight electrical supply situations could become more frequent, especially on cold winter mornings and evenings.

The briefing outlined that the key drivers were New Zealand’s fast-growing electrification (more power demand) and our increased reliance on intermittent power generation methods such as wind and solar.

Unfortunately, this was underlined in August 2024 when prime minister Christopher Luxon suggested that New Zealand had an energy security “crisis” and signalled a review of New Zealand’s electricity market. (1) The law of supply and demand can provide a framework that helps with understanding the various factors driving this energy security crisis.

Security of supply

The capacity of electricity generation to meet consumer demand is referred to as ‘security of supply’ and this winter all signs point to a supply shortage.

The storage of water in our hydro lakes is the primary focus when managing security of supply, however careful management of all fuel sources is required to ensure there is enough hydro capacity.

Investment in battery energy storage systems in recent years has provided an alternate to stored hydro capacity, however New Zealand’s grid scale battery capacity remains low.

According to the Electricity Authority the challenges this year can be attributed to a shortage of natural gas combined with low rainfall that has reduced the inflows to our hydro lakes, as shown in the images of Lake Pukaki.

The ‘greening’ of our national power grid introduces further risk to security of supply, particularly during peak demand windows on cold winter mornings and evenings when generation from wind and solar is less effective.

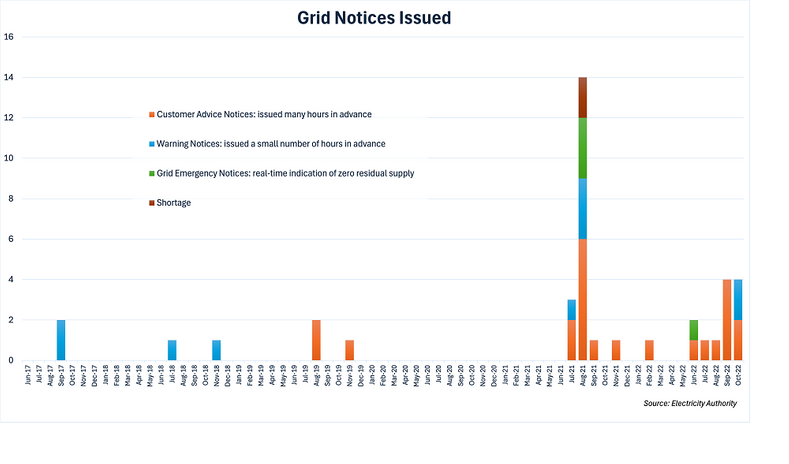

Further data is visible in this chart that plots the number of grid warning notices issued by Transpower since June 2017 and clearly demonstrates the security of supply risk profile growing.

The June 2024 outage in Northland was caused when a power pylon between Helensville and Warkworth fell over during routine maintenance leaving 100,000 Northland properties without power for 48 hours.

The Northland pylon disaster is expected to cost businesses up to $80 million in lost productivity not to mention the impact on households.

All this is happening in the face of ongoing climate change and its increased risk of more dry years and greater incidence of severe storms.

Increased demand

Decarbonising the economy by way of electrification has also driven demand for electricity to accelerate in recent years. The November 2023 MBIE briefing identifies that New Zealand is drawing more power than ever before. Electricity demand and generation scenarios released in July 2024 by MBIE (2) show that total electricity demand growth could be between 35% and 82% by 2050.

In the short term, commercial and industrial sectors are expected to be the main drivers of demand. Hyper-scale datacentre builds are an example of previously un-forecast demand that has the potential to make a material impact on electricity demand. Energy transition from fossil fuels to electricity such as heating, process heat and electric vehicle charging also contributes to further demand.

The law of supply and demand states that if demand exceeds supply, then prices rise. Ignoring the regulations that control the electricity market, for the sake of simplicity, we should not have been surprised by the huge spikes in the average daily wholesale electricity rate seen in August 2024.

The energy sector is responding by promising significantly more generation capacity, though this is expected to take some years to eventuate and is not without challenges in the form of supply chain, environmental consenting, labour costs and interest rates.

The good news is that while these future plans take effect, practicable steps can be taken by New Zealand businesses now to reduce the impact of power surges, brown outs and black outs.

The impact

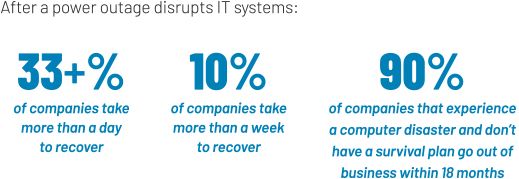

This is before we consider any loss of productivity or materials when machines grind to a halt. The loss of PLC programme data or potential damage to sensitive electronic equipment introduces potentially greater and long-term consequences.

The solution

The business case for investing in clean-power and without-power solutions and strategies has grown significantly more compelling in light of the current macro environment for energy security of supply and reliability in New Zealand today.

Knowing where your business is exposed, having a recovery plan and having protection that ensures business continuity or, at the very least, enables safe shutdown of critical infrastructure is a no brainer. Power continuity should be a long terms business assurance consideration regardless of the national supply situation.

A UPS-based clean power solution will not only provide backup power for your customers’ critical operations and processes, but also protect their sensitive electronic equipment from less obvious damage caused by unclean power.

Deploying a fit-for-purpose UPS solution is vital, particularly when protecting critical operations and expensive equipment. Like most things in our industry, you do get what you pay for.

SOURCES

- https://www.rnz.co.nz/news/national/526233/new-zealand-has-an-energy-security-crisis-christopher-luxon

- https://www.mbie.govt.nz/assets/electricity-demand-and-generation-scenarios-report-2024.pdf